The Disadvantages Of Inflation And How It Affects High School Students

November 16, 2022

Over the last year, things have become more expensive. Gas prices, housing, food, and college funds have greatly increased.

By May the inflation rate had gone up by 8.6 percent in the United States—that’s the highest it’s been in 40 years.

Last summer, President Joe Biden said that the economy has been getting even worse although inflation is going through a decline.

“I truly believe we made extraordinary progress by laying a new foundation for our economy, which becomes clear once global inflation begins to recede.”

The economy has been in decline since 2020 when COVID-19 hit. In addition it had a big impact on the Venice community.

Senior Kylie Kamal has recognized the impact of COVID-19 and how it affects high school students.

“I believe we are feeling the after quakes of the pandemic and many other global issues that have taken place recently,” Kamal said.

Inflation was at its highest by June at exactly 9.1 percent, continuing a record setting run and further decreasing most people’s purchasing.

“Inflation is a detrimental thing within our economy and can have a devastating impact on low income families and in general causes a decline in Americans’ standards of living,” she said. “And from what she has seen and experienced, the amount of unemployed people is getting lower while the demand for employees is rising.

Kamal has witnessed businesses struggling to find employees, and are in desperate need of workers and has caused wages to increase, leading to businesses raising prices as a result.

High school graduates are expected to be free from the dependence of their parents or guardians, so immediately they are exempt from getting paid for everything, such as housing, food, and transportation.

With higher overall cost of attending a college, students will likely need to take out more loans but with the expectancy of higher interest rates, furthering stacking debt on top of debt.

In August 2022, the U.S Bureau of Labor Statistics reported the unemployment rate rising by 3.7 percent, equaling 344,000 to 6 million people.

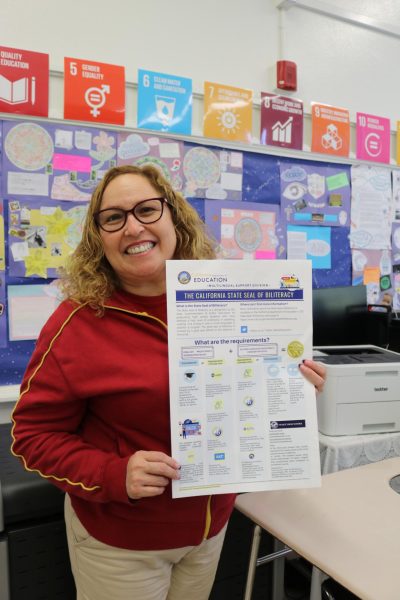

Social studies teacher Ahsan Minhas stated that if the stock market reaches a six month economic downturn, which it most likely won’t, it will be classified as a recession.

Minhas explained the two types of inflation that the government can do—“fiscal policy” or “monetary policy.”

“Monetary policy raises interest rates to hurt low income workers more than the rich, and fiscal policy involves raising taxes for everyone,” he said. “Prices go up, and the value of the money in your pocket goes down.”

This act has the people of the community feeling robbed and taken advantage of.

“I don’t believe that there will be an effective anti-inflation policy because of the country’s need to rely on others for resources,” said freshman Emma Sandoval.

Beginning to doubt the system as young individuals, students like Sandoval then feel as if a single dollar doesn’t comparatively pay for the bare necessities to live as it did merely 6 months ago.

Freshman Issac Martinez Velazquez added that because of the economic issues the community is experiencing, it “leaves us depending on the state for EBT and food stamps.”